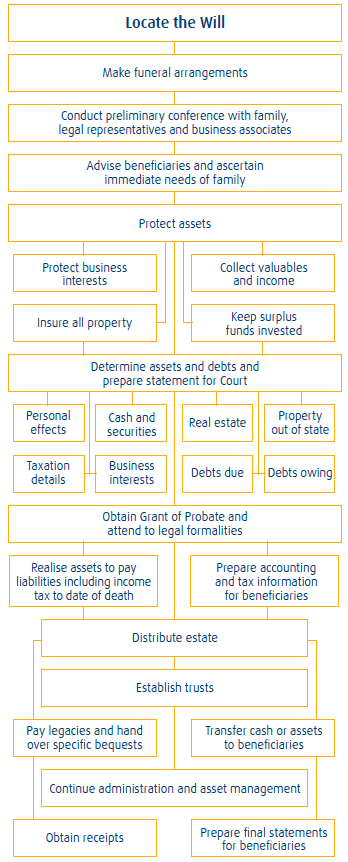

Deceased Estate Flowchart

This is the checklist that we work through with Executors when preparing an Application for a Grant of Probate to the Supreme Court.

KL-Deceased-Estate-Checklist-16.02.2023Executor’s Role

The executor is the person chosen by the deceased person to carry out the terms of their Will. The executor is responsible for the entire administration of an estate until the final distribution of the assets is made to the beneficiaries. During the administration, the executor will control all the assets.

Our Role

We see our role as being that of assisting the executor to do those things that are legally complex (such as applying for Probate) and to advise generally regarding the administration of the estate.

Many tasks that must be done are administrative in nature and do not require any particular legal skill – just attention to detail and with an eye to record keeping. Only rarely will an executor delegate all of their responsibilities to us.

We can also help you with dealing with beneficiaries and with potential claimants against the estate.

Executor’s Duties

The executor must first important duty is to locate the Will and contact the beneficiaries as soon as possible. The executor usually contacts one person to make initial arrangements and gather necessary information to begin the administration of the estate.

The Will may contain funeral instructions or there may be estate matters requiring urgent attention. Funeral arrangements are usually handled by the family in consultation with the executor.

It is the responsibility of the executor to protect the assets of the estate. This may involve storing valuables such as jewellery, ornaments or paintings, or investing surplus funds. Importantly, all property should be insured, as the executor personally is liable for the security of assets.

The executor should notify government agencies of the death to ensure that liabilities do not continue or that income such as a pension is stopped.

The executor must confirm all assets and debts of the estate. This involves writing to financial institutions, government departments, relevant companies, searching records (especially Lands Titles Office) and may also require the preparation of an inventory ofhousehold furniture and personal effects. We will discuss and agree the division ofresponsibility for these tasks when we first meet.

What happens next?

After all the information has been gathered by your executor it is then necessary to apply for a Grant of Probate, to administer your estate.

The Grant of Probate is the document issued by the Supreme Court of South Australia, which legally authorises your executor to deal in all matters relating to your estate.

To obtain the Grant of Probate, your executor must file various legal documents at the Supreme Court, including the original Will, the death certificate and a complete statement of all assets and liabilities of your estate.

Probate cannot be applied for until at least 28 days after the death of the person.

Probate is not required in every situation. We will advise you if you need to apply for a Grant of Probate.

How long will this take?

The Probate Registry usually takes between 6 to 12 weeks from application to grant, assuming they have no further questions.

What will this Cost?

We charge on the Supreme Court scale and our costs are line-itemised. We will be able to give you an estimate of the likely costs at the conclusion of our initial interview.

It is our practice in Estate matters to hold our costs until the finalisation of the matter so as to not place any further burden on the Executors.